Voters to decide proposed constitutional amendments

.

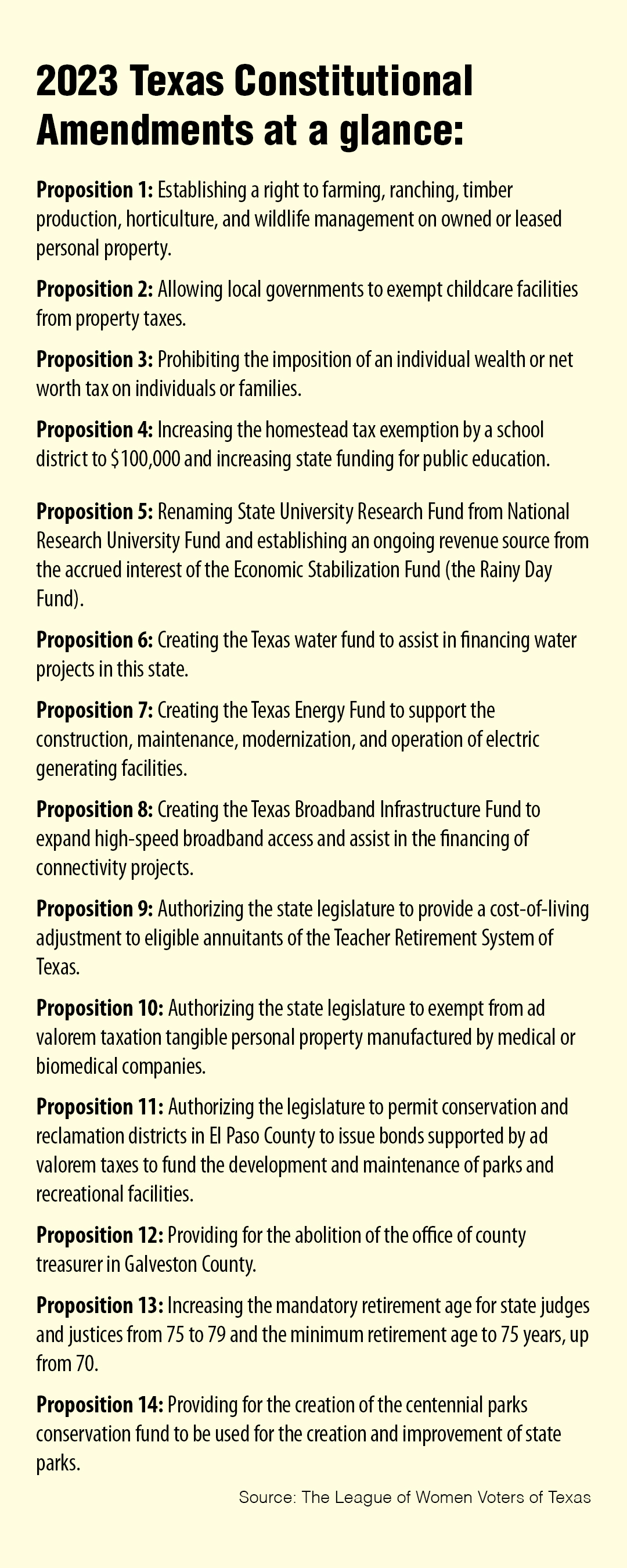

Instead of voting for a person or a party, registered voters throughout Texas get a chance to get their hands on true democracy by deciding on 14 propositions to be added – or not – to the Texas Constitution via the Nov. 7 Constitution Amendment Election. Registration to vote ends Oct. 10 to be eligible to cast a ballot.

To get on the ballot, the constitutional amendments were approved by 2/3 of both the House and the Senate. To get into the constitution, each proposition must receive a simple majority of all votes.

One proposition, No. 4, arguably affects the most Texans and, if approved, would modify certain provisions of the Texas Constitution related to property taxes. Earlier this year, the Legislature approved $12.7 billion in property tax cuts, which needs voter approval to be returned to property owners. If approved, the amendment would increase the homestead exemption from $40,000 to $100,000 on 5.72 million homeowners’ school district property tax bills, effective on this year’s property tax roll.

According to Angela Bellard, chief appraiser for the Jefferson Central Appraisal District, when tallying taxes on a $200,000 home or a $400,000 home, each homeowner saves approximately $1,000 per year under the proposal. Also, the amendment would approve a “catch-up” for over-65 and disabled for the $15,000 homestead exemption increase adjustment from the May 2022 state-wide election.

Additionally, the proposition would approve a temporary limit on appraisals for commercial, mineral and residential properties. The increase in the appraised value for a non-homestead property, such as a business property or second home, cannot be more than 20% over the prior year’s appraised value. Only non-homestead properties with value of $5 million or less qualify currently and this non-homestead property tax limit expires Dec. 31, 2026.

More than $7 billion will be sent to school districts in order to lower their property tax rates and the proposition would allow this money to be sent without counting toward spending limits in the constitution.

Currently, members of local appraisal boards are all appointed and the proposition allows the Legislature to require that, in counties with a population of 75,000 or more, which includes Orange, Hardin and Jefferson counties, three of nine members of a board be elected.

Other propositions

According to the Secretary of State’s Office, Proposition 1 would protect the right to engage in farming, ranching, timber production, horticulture and wildlife management on owned or leased personal property.

Proposition 2 would exempt childcare facilities from ad valorem taxation by a county or municipality of all or part of the appraised value of real property used to operate a child-care facility.

Proposition 3 prohibits the imposition of an individual wealth or net worth tax, including a tax on the difference between the assets and liabilities of an individual or family.

Proposition 5 relates to the Texas University Fund, which provides funding to certain institutions of higher education to achieve national prominence as major research universities and drive the state economy.

According to the Texas Tribune, if passed, the National Research University Fund would be renamed to the Texas University Fund (TUF) and would gain the annual interest income, dividends and investment earnings from Texas’ Rainy Day fund to support research at state universities. Money moved to the TUF would be limited to $100 million in Fiscal Year 2024. The annual amount may be adjusted for inflation and is limited to a 2% growth rate.

The Texas A&M and University of Texas systems will not receive money from the fund as they receive research funds from a separate Permanent University Fund.

Proposition 6 would create the Texas Water Fund to help in financing water projects in this state. A portion of the fund would have to be used for water infrastructure projects in rural areas as well as for water conservation strategies and water loss projects.

At least 25% of the fund would be used for the New Water Supply Fund for Texas, which will support projects to increase the state’s water supply, the Tribune reported.

Proposition 7 would create the Texas Energy Fund to support the construction, maintenance, modernization and operation of electric generating facilities. It would allow officials to distribute loans and grants to companies with the aim of building new natural gasfueled power plants. The Legislature set aside $5 billion to fund these programs for the next two years.

If voters approve Proposition 8, it would create the Broadband Infrastructure Fund to expand high-speed broadband access and assist in the financing of connectivity projects. More than $1.5 billion would be allocated to expand internet availability, where more than 7 million Texans currently lack access.

Eligible annuitants of the Teacher Retirement System of Texas could see a cost-of-living adjustment by the 88th Legislature, if Proposition 9 passes.

Proposition 10 would authorize the Legislature to exempt from ad valorem taxation equipment or inventory held by a manufacturer of medical or biomedical products to protect the Texas healthcare network and strengthen our medical supply chain.

Proposition 14 would create the Centennial Parks Conservation Fund to be used for the creation and improvement of state parks. The Legislature propose investing more than $1 billion for state parks.

Two of the amendments do not pertain to Southeast Texas — one for El Paso County and the other for Galveston County.

Proposition 11 would authorize the Legislature to permit conservation and reclamation districts in El Paso County to issue bonds supported by ad valorem taxes to fund the development and maintenance of parks and recreational facilities.

Proposition 12 would abolish the office of county treasurer in Galveston County.

Concerning the state judges and justices, Proposition 13 would increase the mandatory retirement age from 75 to 79 and the minimum retirement age to 75 years, up from 70.

This will be the sixth Constitution Amendment Election since 2014. The 2019 election drew only 12.43% (1.984 million) of the registered voters and less in the 2021 election with 8.75% (1.485 million).

According to the Secretary of State, there were 17.672 million registered voters for the 2022 Gubernatorial Election which drew 45.85% (8.1 million).

Early voting begins Monday, Oct. 23, and ends Friday, Nov. 3. The deadline for mail ballot application is Friday, Oct. 27.