June 11, Hardin County Commissioners voted to table action on approving an application by Blackfin Pipeline, LLC, for a 70% property tax abatement exemption for 25 years. The vote came after a presentation by Cody Morgan and Chad Wigington with KE Andrews Property Tax Consultants. Morgan noted that the company puts together applications for tax abatement for Blackfin Pipeline, LLC.

After the commissioners discussed the request, County Judge Wayne McDaniel said the court could table the matter and let KE Andrews submit an amended application. McDaniel said the matter could be taken up again at the court’s next meeting, 10 a.m., Tuesday, June 25.

“We want it to make sense and be a mutual benefit to everyone,” Wigington said.

McDaniel said that, before this decade, tax abatements were “easier on both sides.” Furthermore, more employees were served in past tax abatement agreements.

“We have one industry partner in Silsbee and we’ve done two tax abatements for it in the last 10 years,” McDaniel explained. “They employ 70 or more people – and ya’ll are looking for a tax abatement that employs just two people.”

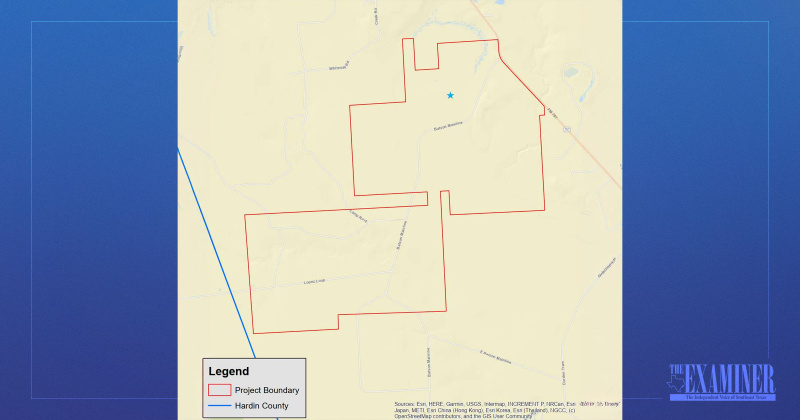

Reviewing the company’s request, Pct. 1 Commissioner L. W. Cooper Jr. noted Blackfin has narrowed the location of the compressor station between Hardin and Liberty County. Morgan said the group will revise the application as per the recently noted specs and bring it back before the court.

“We’re trying to find the best option for them to place it,” Morgan said, copresented Wiginton adding on that that, “We want to pursue this and get the ball rolling.”

Morgan added that the Hardin Compressor Station, when established, will create hundreds of construction jobs and will provide two permanent full-time positions. The project is anticipated to commence construction in the fourth quarter of 2024 and will be fully operational in the third quarter of 2025.

Pct. 2 Commissioner Chris Kirkendall said he’s not in favor of the abatement application – at least in its current state – because the taxable values will decease “so dramatically.”

“The No. 1 taxpayer in Hardin County is in my precinct and I’m their commissioner,” Kirkendall said, talking about South Hampton Resources, near Silsbee. “They have never asked for anything like this. So, to be fair to them, I could not support this because they are in the chemical business, as well.”

According to the application for property tax abatement exemption for Blackfin Pipeline LLC, the company is requesting that Hardin County consider the creation of a reinvestment zone and the approval of a Chapter 312 Tax Abatement Agreement for the project. The abatement, a local agreement between a taxpayer and a taxing unit that exempts increases in the value of the property from taxation for up to 10 years according to the Texas Comptroller's Office, is an economic development tool available to cities, counties and special districts to attract new industries and to encourage the retention and development of existing businesses through property tax exemptions or reductions. School districts may not enter into abatement agreements.

“In addition to the $70 million investment to the county, the major economic benefits over the next 25 years are expected to include $3.1 million of county property taxes and over $11.9 million of school taxes for West Hardin CCISD, as well as ensuring the ability of Blackfin Pipeline, LLC to be located within Hardin County,” Morgan wrote in the company’s proposal. The application map shows the proposed reinvestment zone as located between Thicket and Saratoga on FM 787, near the Hardin-Liberty County line. The compressor station will be located within the West Hardin County Consolidated Independent School District.

The application lists that Blackfin Pipeline, LLC does not currently own any property within the proposed Reinvestment Zone. The requested tax abatement agreement between Blackfin and Hardin County would be the equivalent of a 10-year, 70% abatement. Specifically, the abatement is requested to be structured as a 100% abatement coupled with a payment in lieu of taxes (PILOT) of $87,634 per year for a total of $876,343.

Blackfin additionally agreed to reimburse the county for any reasonable consulting and attorney fees as may be incurred in preparation and negotiation of the abatement agreement. Kirkendall noted yet another industrial consumer, Union Gas, is looking at constructing a compressor station in his precinct.